When you purchase a made use of, you might be basically playing one to an inventory’s rate will go down. You should buy an utilized to take a position for the a good downturn otherwise so you can hedge an inventory your already individual. Blain Reinkensmeyer provides 2 decades away from change knowledge of more 2,five hundred investments set at that time.

The worth of Bonds fluctuate and you can people opportunities sold before maturity may result in gain or death of prominent. Generally, whenever interest rates increase, Bond prices usually shed, and you may the other way around. Securities having highest production otherwise provided by issuers having all the way down borrowing recommendations generally hold a high level of exposure.

Spreads:

CFDs try complex devices and you can come with a leading threat of taking a loss easily due to power. You need to know whether you probably know how the product performs, and whether you can afford to take the fresh high-risk out of dropping your bank account. If you buy an alternative you could make money when the the new investment’s rate actions beyond the strike price (over for a visit, lower than for an used) from the more the newest advanced you first paid before conclusion time. For individuals who imagine on your own a good speculative buyer or if you such as becoming a little more give-to your with your portfolio, alternatives could easily increase otherwise manage forget the strategy. Options change involves risks, including the possible loss of your entire funding.

This information is to own educational objectives just and cannot end up being removed since the money guidance, personal testimonial, or an offer from, or solicitation to, pick or sell one financial tool. A protective set work such as insurance coverage — they allows you to continue any upside if you are locking inside at least worth but if anything go bad. Merchandising options https://aalegalgroup.com/2025/09/pre-field-trade-everything-you-need-to-discover/ frequency have actually overtaken institutional change, marking a fundamental change in the way industry works. However, why are alternatives its fun isn’t merely the development nevertheless the freedom they’re able to give the collection. Task is actually arbitrary and certainly will takes place whenever prior to conclusion, though it normally goes later regarding the conclusion cycle. Jiko AccountsJiko Bonds, Inc. (“JSI”), a subscribed broker-specialist and you can person in FINRA & SIPC, will bring membership (“Jiko Account”) offering six-week All of us Treasury Debts (“T-bills”).

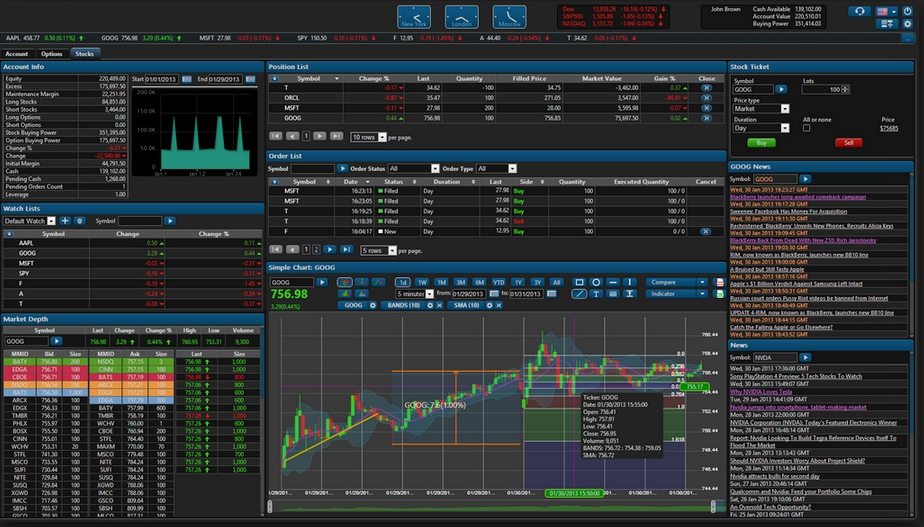

Endless $0 Investments

Imagine an excellent trader really wants to purchase $5,100000 inside Fruit (AAPL), trading around $165 for each express. Suppose up coming the price of the brand new inventory develops from the 10% to $181.50 along side 2nd week. Disregarding any brokerage commission or exchange costs, the fresh trader’s profile usually go up to help you $5,445, leaving the new investor that have an online go back of $495, otherwise 10% to the investment spent. Choices change can be more state-of-the-art and you may riskier than simply stock trading.

You to tip is to start by quick assets and you may gradually raise their visibility as you acquire feel. This may additionally be value trying to advice out of another economic top-notch. Deciding on the best strike price hinges on your strategy and you can attitude. To possess big development, you’d wade subsequent aside-of-the-money, but with greater risk.

It issue isn’t designed as the a suggestion, provide, otherwise solicitation to shop for otherwise sell securities, open a broker account, or take part in people funding approach. The fresh speculative consumer first purchases an option at the cost of the brand new lay superior. Then they purchase the underlying advantage during the their straight down, already-set rates (which is also known as its strike speed).

Before you could begin investigating monetary types, it’s vital to weighing the potential risks and you will advantages. Exploring possibilities change subsequent have a tendency to deepen your knowledge for the expert monetary equipment. It part serves as your own compass, guiding your from principles from choices trade.

An important matter to keep in mind is that options will likely be considerate and you will proper. They’re not for just highest-running hedge finance managers or Wall structure Path wizards. If you know how they work, you could potentially certainly make use of them to make money, boost profits, and even manage on your own up against losses in the a declining field. Investment try deals that provides you the best — although not the responsibility — to purchase or offer a stock in the a pre-consented rates in this a specific time frame.

These issues sign up for the new option’s superior, which is the speed repaid from the buyer to find the newest solution offer. Another chance is to promote the phone call choice to other people earlier expires, giving them the right to purchase Red-colored Pizza shares during the below-market price of $fifty for each display. Within this circumstances, you’d benefit investing only the choice; you’d never ever very own genuine Red-colored Pizza pie offers. Solution bargain proprietors aren’t needed to take action their legal rights to buy otherwise promote shares. They’re able to allow the choice expire worthless (and you will forfeit whatever they allocated to they), or they’re able to offer the option deal to some other investor to own any count you to definitely trader try willing to pay. In case your offer’s well worth develops, they are able to make money instead of ever before exercise the possibility or needing to own the new stock.

A call substitute for purchase $ten for each and every section of the FTSE that have an attack price 7100 perform enable you to get $ten per point that FTSE movements more than 7100 – with no margin your paid off to start the career. You need an account with an excellent leveraged change merchant, for example IG, to help you trading CFDs. Choices are leveraged things much like CFDs; they will let you imagine on the direction of an industry instead of actually having the underlying resource. This means your wages is going to be magnified – as can your loss, if you’re also promoting alternatives. You think it’s likely to rise (that’s the reason you bought the fresh shares to start with), nevertheless’lso are simply not yes.

The newest a shorter time there is certainly up until expiration, the newest quicker worth a choice are certain to get. The reason being the chances of an amount flow from the fundamental inventory fade as we draw nearer to expiry. If you buy a-one-day choice which is out from the money, as well as the stock doesn’t move, the option gets shorter valuable with every passageway time.

The brand new strike pricing is the cost at which you should buy otherwise promote the newest stock if you decide to take action the newest offer just after purchase. Now, the modern manager of the company would want to understand you might be significant. Whether it have been a strategies offer, one deposit was described as the brand new advanced. Remark your preferred broker’s very first deposit criteria and you can membership brands to help you see just what tend to fit your greatest. For many who currently exchange a specific investment and wish to department away to your different ways away from seeing the market industry, then alternatives trading is generally to you. This approach generally combines attempting to sell an atm straddle and purchasing protective “wings.” You may also think of the framework since the a couple of develops.